Financial Reality Check: Personal Finance and Budgeting Work for Beginners/Teens |

Financial Reality Check is the practical personal finance book I wanted for my own sons and couldn't find, so I created it!

This finance curriculum gives junior and senior high school students the opportunity to experience some of the financial challenges they will face with independent living. The goal of this eye-opening personal finance experience is to give students a glimpse into what costs they can expect and to help them learn to take responsibility for personal financial decisions with the use of a Monthly Budget.

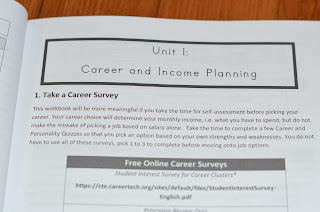

Students begin the book by taking personal inventories to help them chose from a list of entry level positions in 16 career fields. Job options also include information regarding the education level needed to obtain that position and if health benefits are provided.

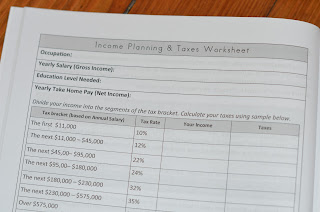

Students will then identify their tax bracket and calculate their monthly take home pay.

Using their monthly take home pay students will work through several Expense Chapters where they make decisions about how to live independently while staying within their budget. For example, at the Housing Chapter they will be given several options including renting or buying, then must weigh the pros and cons of each.

The reality check helps students become more aware of the true costs of living, including the many hidden costs they may not have considered, like renter’s insurance, mortgage rates, and utilities. They'll complete similar exercises in domains such as food, transportation, pets, maintenance, etc.

Some Skills Learned:

- Identify how personal strengths and interests determine career choice

- Identify how career choice, education, skills, entrepreneurship, and unexpected life events affect income

- Identify tax bracket, gross versus net income, and employee health benefits

- Calculating single and multi digit fractions, along with addition/subtraction needed in monthly budgeting

- Responsibility for personal financial decisions with the use of a Monthly Budget

- Identify the relationship between spending practices and achieving financial goals.

No comments:

Post a Comment