|

| Game of Life Financial Reality Fair |

|

| PDF Download |

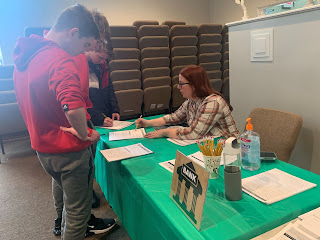

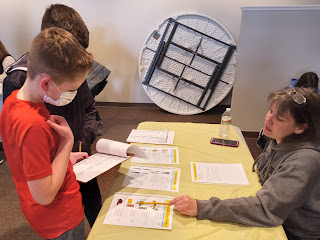

My heart is so full after creating and organizing this event for our local homeschool community! We had FIFTY Junior and Senior High students, including my sons, take part in this fair. Both my boys have already asked if we can do it again so they pick another job and see how they can budget with a different income!

The Teen Financial Reality Fair is an immersive budgeting experience that gives students a glimpse into what it costs to live independently, and how take responsibility for personal financial decisions with the use of a Monthly Budget Tracker.

Junior high and high school students will have the opportunity to encounter some of the financial challenges they will face as an adult, such as cost of housing, entertainment, and transportation. This toolkit is flexible and can be used in a variety of educational settings, such as a homeschool cooperative or public school.

What makes this curriculum different from other reality fairs?

I remember doing a fair similar to this in my public school junior high, and when I couldn't find one that had all the components I needed/wanted, I decided to make my own!

- Homeschool Oriented Many of the other examples I found were built for public schools, with the pre-work all done in a traditional classroom. The toolkit I made includes homeschool registration forms, pre-fair student packet that can be done at home, and tips on how recruit volunteers that are not teachers in the building.

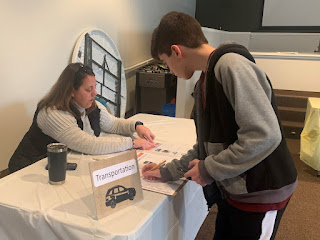

- No Personal Loans Almost every Financial Reality Fair I found as an example directed students to get a personal loan at the end of the month if they went over their budget. This fair instead directs student to revisit tables to change their spending to fit into their income. If they have money left over at the end of the month, they are directed to go back to the savings/investment table to save it for a specific goal.

- Student Pick their Job based on Self Reflection Many of the fairs also assign the student their job. I remember in 8th grade being very frustrated at injustice of being assigned a mechanic that made minimum wage and the class pot head was assigned a doctor! and I wanted my teens to take some personal surveys that could help them identify how their strengths would translate into a career. Links to surveys are included in the kit.

- Entry Level Salaries All Salaries are entry level, none over $75,000. Too many times we tell students their chosen profession's top salary, instead of preparing them to start at the bottom and work their way up.

- Identify how career choice, education, skills, entrepreneurship, and unexpected life events affect income

- Identify the effects of tax bracket, gross versus net income, and employee health benefits

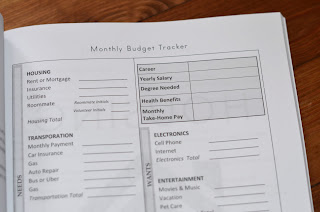

- Demonstrate responsibility for personal financial decisions with the use of a Monthly Budget Tracker

- Gain awareness of debt on a monthly budget

- Determine how charitable giving can fit into a personal budget and appropriate percentages for giving

- Identify the relationship between spending practices and achieving financial goals

- Understand the importance of saving money on a regular basis

- Explain the relationship between saving practices and achieving financial goals

- Devise an investment plan for accumulating money for retirement

Reality Fair Procedure

The Financial Reality Fair consists of two parts:

1. Job Choice & Income Planning (In classroom or done at home)

Students must complete the Student Pre-Fair Packet before the fair.

The Pre-Fair Student Packet Includes:

- Career and Personality Quizzes

- Pick their job option from list of entry level positions

- Income Planning Sheet- calculate their monthly take home pay after taxes

You can use the given job salaries, or research local starting salaries in your area. Their job choice also includes information regarding the education level needed to obtain that position and if health benefits are provided, which is data they will need as they visit the reality fair booths.

Reality Fair Planning Toolkit

The planning toolkit provides:

REALITY FAIR

- Reality Fair Procedure

- Reality Fair Objectives

- Individual Booth Objectives

PLANNING TOOLS

- Planning Timeline

- Materials Needed

- Volunteers Needed

- Resources for Local Prices

- Sample Booth Layout

FORMS

- Sample Parent Letter

- Homeschool Parent Letter

- Registration

- Student Evaluation

PRE-FAIR STUDENT PACKET

- Career Survey links

- Job Options

- Blank Job Options

- Income Planning Sheet

BOOTHS

- Prefilled Booth Informational Pages, with costs of independent living

- Blank Informational Pages, with links to help you research costs of living in your local area.

You can purchase PDF Download

The toolkit is available for purchase in PDF download in my Teacher Pay Teachers store and provides you with all the information and planning resources needed to host in any homeschool community!

|

| PDF Download |

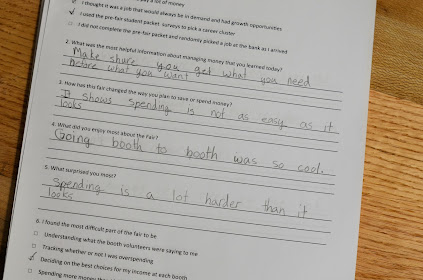

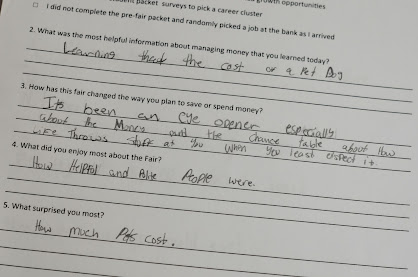

Student Evaluations

No comments:

Post a Comment